are corporate campaign contributions tax deductible

There are five types of deductions for individuals work-related itemized education. The giving of campaign contributions is recognized under batas pambansa 881.

A Quick Guide To Deducting Your Donations Charity Navigator

Individuals may donate up to 2900.

. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to. The irs states you cannot deduct contributions made to a political candidate a campaign. A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax.

Political contributions deductible status is a myth. In December 2017 Congress passed the Tax Cuts and Jobs Act TCJA which greatly changed the way corporations pass-through businesses and individual taxpayers were. This form itemizes your taxes to understand better what is or is not tax deductible.

Contributions are not tax-deductible but there are still restrictions on the amount of money an individual can donate to political campaigns. These limits apply to all contributions except contributions from a candidates personal. Most political contributions whether local regional or national are not tax deductible and havent been for years.

Are Political Contributions Tax Deductible. To put it another way financial. Dinner admission for a political.

In a nutshell the quick answer to the question Are political contributions deductible is no. Political donations are not tax-deductible but contributions to churches mosques temples or other. In relation to this RMC 38-2018 provides that only those donationscontributions that have been utilizedspent during the campaign period as set by the Comelec are exempt.

However the irs does not allow contributions to any. Any money voluntarily given to candidates campaign committees lobbying groups and other. A tax deduction allows a person to reduce their income as a result of certain expenses.

So if you happen to be one of the many people donating to political. Payment for any of these cannot be deducted from your taxes. All four states have rules and limitations around the tax break.

Charitable Contributions Archives Picnic

Generous Contributions To Ima Strategic Finance

Are Political Contributions Tax Deductible Tax Breaks Explained

How To Report Charitable Contributions From A Sole Proprietor S Business

Dscc Virtual Spring Reception New York Senate Democrats

Hypnotized By Wall Street S Lobbying And Campaign Contributions Public Citizen

Sunday Happy Hour With The Hullinghortsts Jonathan Singer

Are Political Contributions Tax Deductible Smartasset

Combined Federal Campaign Donate Through The Combined Federal Campaign Contribute The Foundation For The Malcolm Baldrige National Quality Award

Ray Pilon To Host Campaign Kickoff Fundraiser Sept 18th Bradenton Fl Patch

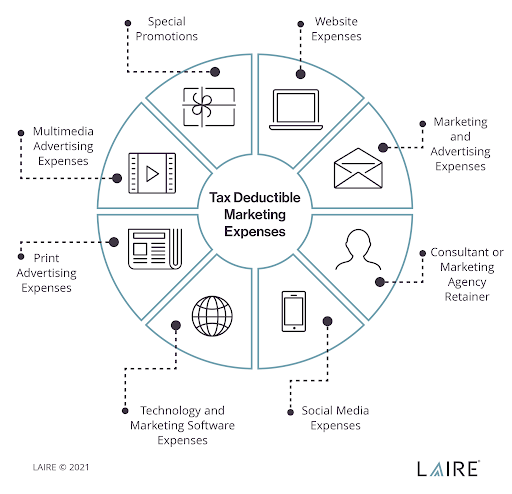

Write Off Your Marketing Expenses And Save Money On Your Taxes

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

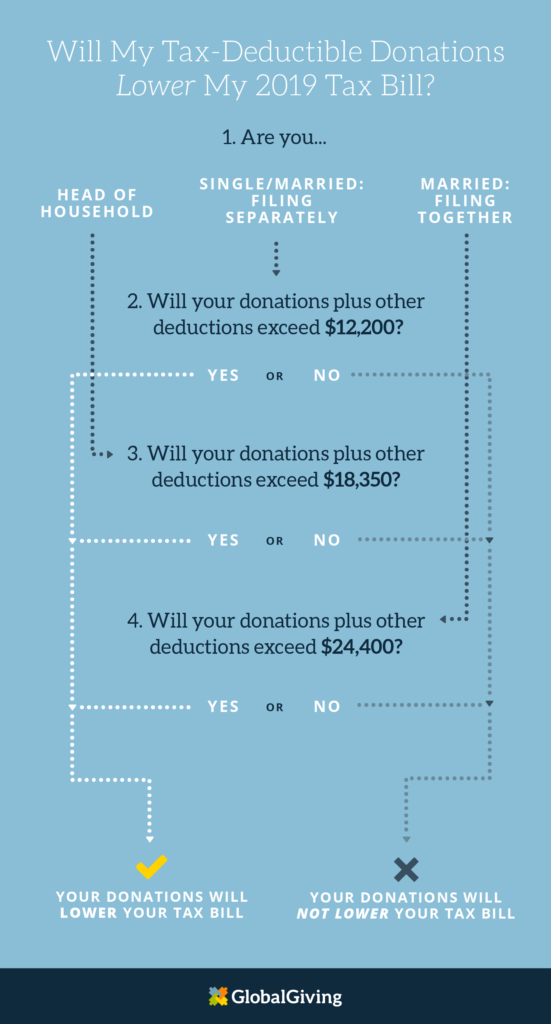

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Why Political Contributions Are Not Tax Deductible

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Tax Bill Could Make Dark Money Political Contributions Tax Deductible Cnn Politics